Is Your Phone System Limiting Productivity?

Click to Contact Paul Steberger Directly

As utility auditors, we are witness to the full extend of monopolistic bureaucracy whenever we deal with a major utility. Critiques of power companies throughout the nation are certainly earned, and we found this one from Jac VerSteeg of the South Florida Sentinel to be particularly judicious.

Ernestine, one of Lily Tomlin’s most hilarious characters, made devastating fun of the Bell system phone monopoly. One sketch featured Ernestine strolling through a high-tech control center. “Here at the phone company,” she says, “we handle 84 billion calls a year, serving everyone from presidents and kings to the scum of the earth.”

She says the company realizes that sometimes customers can’t reach an operator, find their phone is out of order or are billed for calls they didn’t make. “We don’t care,” Ernestine says. “We don’t have to. We’re the phone company.”

With the breakup of the “Ma Bell” monopoly in the early 1980s, all that has changed. Now phone companies engage in savage competition for services that are radically different. But the spirit of arrogant monopoly utilities continues. Ernestine’s applause line now could be: “We don’t care. We don’t have to. We’re the power company.”

Florida Power & Light is a good example. I’ll grant that FPL delivers reliable, reasonably priced electricity. But FPL’s attitude is becoming too Bell-like. They don’t compete for customers. They compete for lawmakers and regulators. And they are winning….

Every year, there are thousands and thousands of cases – ranging from modest to the extreme when it comes to utility overcharges.

At times, these become public – such as the controversy in North Carolina regarding the utility company’s ability to charge customers at a high tax rate that no longer exists.

Most often, however, these kinds of overcharges go completely undetected. It never ceases to amaze us how often people will complain about the costs of their utilities, and never realize just how right they are.

For those who take the next step and call a Utility Auditing Specialist, it is rare not to find at least one error, inappropriate rate, or improper tax classification. With over 150 components to every utility bill, there are at least 150 chances per bill that you are being overcharged – and that’s before checking the meter’s accuracy.

Remember that in companies as large and bureaucratic as utility companies, especially those with no local competition, have about ZERO interest in providing you the best possible service at the best possible price.

That’s where we come in. We have decades of experience navigating the murky depths of Utility Bills. If you think you’re being overcharged, don’t hesitate to call Paul Steberger of Applied Utility Auditors TODAY.

Did you know that utility companies often have more than one rate for commercial/business clients? Guess what? They don’t hand out the best rates automatically. Customers have to seek better rates for themselves. This process can be tedious, and frankly, you’re already busy running your own business. This is where Applied Utility Auditors can help. We find overcharges for 80% of all clients.

You might be reading this because your business was referred to AUA or because we’ve contacted you about conducting a utility audit and you have questions. We’re fortunate that the majority of our customers come from happy client referrals. Here are a few quick points:

First, you’re in good hands. Our team has over 75 years of collective experience in auditing:

• Telecom

• Electric

• Gas

• Water/sewer services

• General bill auditing

Second, our job is to find:

• Errors

• Overcharges

• Incorrect rate group assignments

Third, we get to work by:

• Auditing your invoices

• Analyzing usage

• Identifying the errors

Fourth, you reap the benefits:

• Cost and service recommendations are made

• New rates are negotiated with the utility provider

• Everyone’s favorite part: You score a REFUND!

• We continue monitoring your utility bills monthly basis to ensure accuracy

How does it work?

• Audits are performed on a contingency fee basis

• No errors = no charge to you

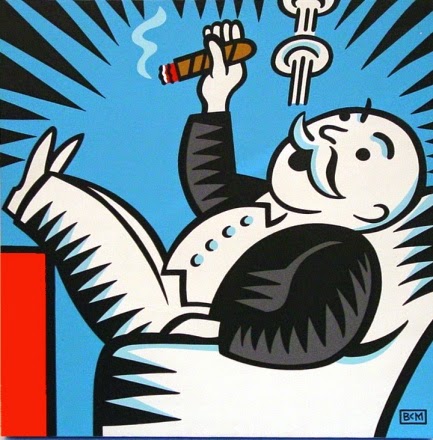

While reading a recent post by Ron Miller at Techcrunch earlier today— I had an opportunity to reflect on just how much more clutter my office used to have. The picture from his blog post says a lot:

This picture, too reminds me of what my own storage closet looked like:

We updated our antivirus software just the other day. Remember when there were giant boxes filled with cd’s, handbooks, pamphlets, etc? All we did was click “download” and use the codes from our receipt to activate the product… More simple than that, the cloud has made it possible to download life-improving software by tapping on the ‘playstore’ or ‘appstore’ icons on our phones.

Software doesn’t have to come in stacks of hard boxes anymore.

If you still have boxes full of programs in your offices, there’s a good chance you could benefit from moving to cloud based services… and there’s no doubt that your cleaning service will benefit too.

Today, the entirety of my office essentials fit inside the laptop bag — and when you consider that I can tap a few buttons on my phone and send a 20 page collated document from the cloud to my local staples, complete with custom specifications… one wonders why people own more than a laptop and a phone.

If you suspect that you may be getting overcharged on a utility bill… there are at least 150 chances per bill that you’re right.

Rate Optimization

→ There are numerous rate schedules available for a particular business’s account. These rate schedules also change from time to time. We can determine if a new rate might be advantageous to our clients. There is no legal or tariff rule that obligates the utility to determine what rate is best for you, so it is not uncommon to find oneself with an unsatisfactory rate schedule.

The average layperson may find themselves in far over their heads when trying to determine the best rate schedule on their own. With our expertise, we can sort through and find what will work best for each client.

Recovery Audits:

→ Every year millions of dollars are billed to utility clients that are incorrect, and, to a large extent, they are in favor of the utility. Many businesses are surprised to learn that is not the responsibility of the utility to correct errors. You may very well be paying too much for the utilities your company uses.

Don’t give your utility company a bonus. When you’re over your head in overhead, call Paul Steberger of Applied Utility Auditors.

By

It was 10 nights before Christmas, and all the way down Wall Street the coast was clear.

A flatbed truck turned the corner and lurched to a stop in front of the New York Stock Exchange. Arturo Di Modica and his small band of co-conspirators jumped out and quickly got to work. The night watchman had just completed his patrol of 11 Wall St., and, having cased the block for several nights, Mr. Di Modica and his team knew they had just 4½ minutes until he returned.

They lowered the bronze statue—all 3½ tons of it—onto the middle of Broad Street, right under the exchange’s Christmas tree. The truck zoomed out of sight, but Mr. Di Modica stood at the corner, watching and waiting for morning.

It was 25 years ago that Wall Street’s favorite mascot arrived downtown. Mr. Di Modica, the Italian artist who says he spent $350,000 of his own money to cast “Charging Bull” in his SoHo studio as a Christmas gift to the city, relished the reactions of New Yorkers—traders, tourists, cabdrivers and hot-dog vendors.

“It was love right away,” recalled Mr. Di Modica, now 73 years old. “They wanted to touch it, embrace it—it was beautiful. I stood there watching until about noon.”

Executives at the New York Stock Exchange weren’t nearly as amused. The police were called in, and when they proved unwilling or ill-equipped to run an 18-foot-long bull out of town, the exchange hired private contractors to haul the beast off to Queens.

Mr. Di Modica, who for years plopped his works onto city streets in the middle of the night, should have been used to this sort of thing. But even though his bull seemed menacing—nostrils flared and ready to gore anything in its path—the sculpture, he said, was intended as a symbol of New York’s drive, optimism and willingness to barrel ahead against the odds.

The artist conceived “Charging Bull” during the city’s most bearish hour, just days after the stock-market crash on Oct. 19, 1987, known as Black Monday.

Mr. Di Modica, a Sicilian immigrant who had found success in New York—enough to buy a Manhattan studio and a Ferrari—remained hopeful for his adopted home at a time many were convinced the city’s best days were behind it. Though the market had recovered much of its losses by 1989, the city was still a crime-ridden shadow of its former self.

Then-NYSE President and Chief Operating Officer Richard Grasso couldn’t be reached to corroborate the story, but Mr. Di Modica said the Wall Street leader offered to return the bull to the exchange on one condition: that the artist would make a bear too. Mr. Di Modica said he refused. “The bear means the market goes down, but I wanted to represent the city getting bigger, stronger, faster.”

Mr. Grasso, recalled Mr. Di Modica, hung up.

Mr. Di Modica paid to bail “Charging Bull” out of Queens, and with the help of community activists and the city’s Parks Department found a new home for him just a few blocks away from the exchange in Bowling Green.

There he has remained for 25 years, through bullish and bearish times alike. He has witnessed the drop in crime, the rise in real-estate prices and the election of a billionaire mayor. He has also stood firm through the dot-com bust, two terrorist attacks—Sept. 11 left him covered in a thick layer of soot—the worst economic collapse since the Great Depression and the Occupy Wall Street protests.

Mr. Di Modica has likely recouped the expense of building the bull several times over in the past 25 years, having cast sibling bulls for cities around the world, and having sold many smaller versions to collectors.

Whenever the market is down, people stop him in the street and ask, “Why isn’t the bull working?” he said. “I tell them he’s resting, he’s tired, but he’ll get back to it soon.”

Corrections & Amplifications

Richard Grasso was president and chief operating officer of the New York Stock Exchange 25 years ago. An earlier version of this article incorrectly described him as the NYSE chairman at that time.

![Cloud Computing – Fact or Fiction? [Infographic]](https://appliedconsultinggroup.net/wp-content/uploads/2014/12/Cloud-Computing-Fact-Or-Fiction-info-244x675.jpg)

How can Mobility help you?